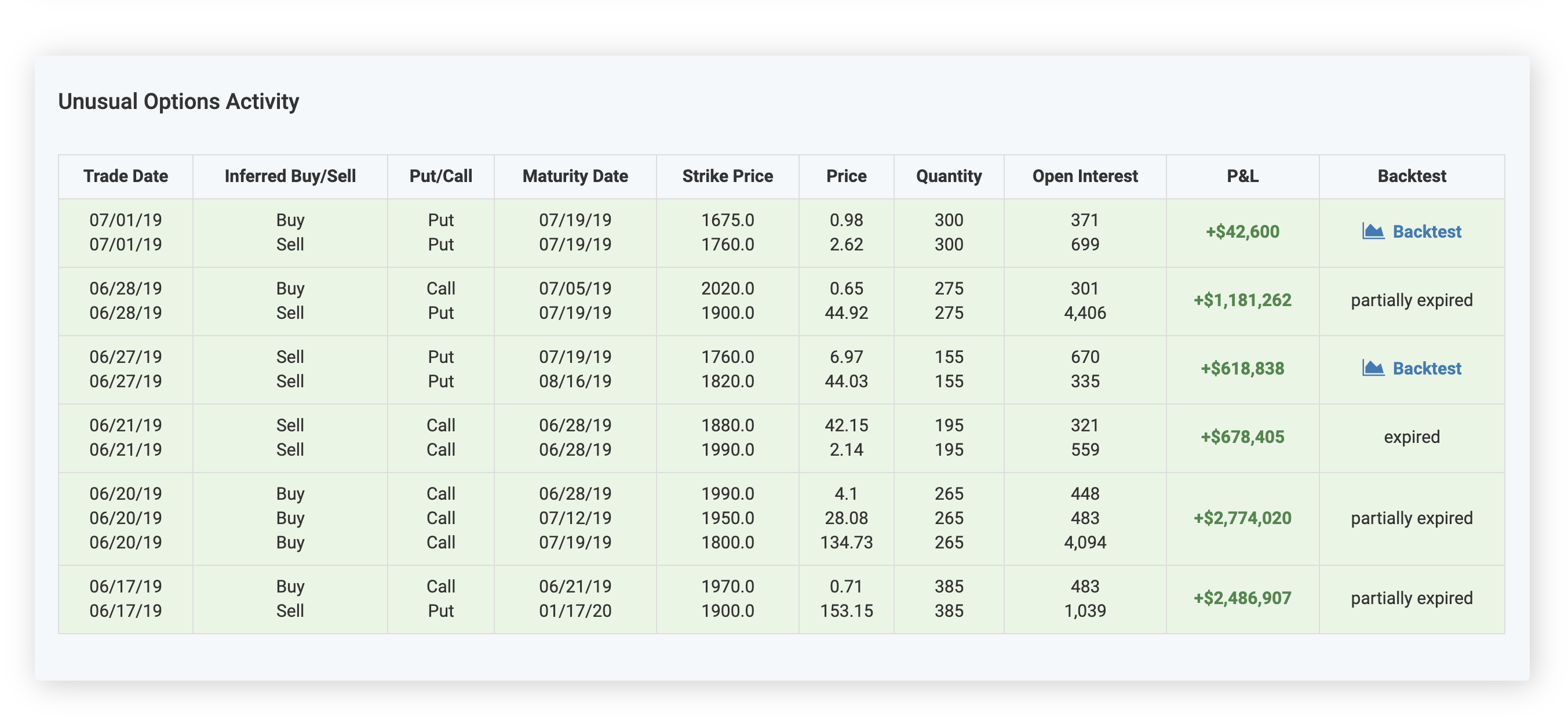

This suggests options traders are picking up puts at a much quicker-than-usual clip. Unusual Options Activity identifies options contracts that are trading at a higher volume relative to the contracts open interest. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity's 10-day put/call volume ratio of 1.03 sits higher than 88% of readings from the past year. Unusual Options Activity The table below is a calendar list view of unusual options activity which shows contracts which are trading at abnormal volume levels or price levels. By observing these events, it can give individual traders clues as to whether large traders and institutions are building up a position ahead of a significant move in the underlying stock. Short sellers have also been targeting the stock, with short interest rising 10.7% in the last reporting period. Unusual options activity is when an option experiences an unusually high volume of trades relative to the average daily volume. RBC just slashed its price target to $110 from $115 earlier this morning, and of the 27 in coverage, 15 called the stock a "hold" or worse coming into today. Traders bought 3,012 call options on the company. Lots of buzz around Unusual Option Activity (UOA) so thought Ill share out this scanner that I fine tuned for my personal use. Now, the security will need to overcome recent pressure at the 60-day moving average if it wants to trim its more than 33% year-to-date deficit. (NYSE:PLD - Get Rating) was the recipient of some unusual options trading activity on Wednesday. The equity's performance was choppy during the past few months, but all pullbacks since mid-July were captured by the $100 mark. On September 26th and September 13th, Market Rebellion’s unusual options activity identified two instances of big bearish put buying in Credit Suisse. The credit market isn’t the only group of market participants who were sniffing out a way to protect themselves from a potential bank bust. In response, ABNB is up 0.5% at $111.35 before the open. Unusual Options Activity in Credit Suisse.

The analyst said the stock's valuation is "no longer an obstacle," and added that Airbnb could be the largest travel platform within the next five years. The shares of Airbnb (NASDAQ:ABNB) are higher this morning, after Bernstein initiated coverage with an "outperform" rating and a $143 price target.

0 kommentar(er)

0 kommentar(er)